Can Messaging Apps Disrupt International Money Transfers?

Transformations in the International Money Transfer Landscape

In the past decade or so, the international money transfer sector has undergone significant changes. The emergence of new players is challenging the dominance of traditional banks and giants like Western Union and MoneyGram. This increased competition has been beneficial for consumers, notably reducing average transaction fees from over 12% to around 7.5%. This shift might be the precursor to a more substantial transformation, driven by the rise of "super apps." These platforms, evolving from simple social networks, are becoming multifaceted tools integral to various aspects of daily life.

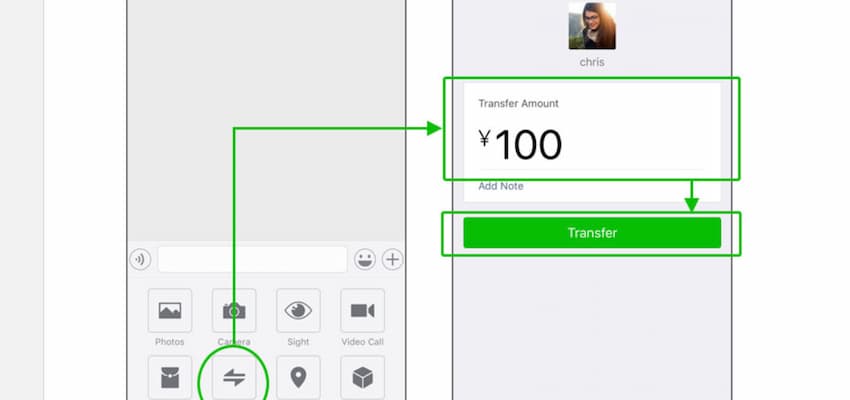

The Rise of WeChat:

Originally a messaging app, WeChat has rapidly expanded into a central hub in China, encompassing messaging, social media, and payment services. It has built an extensive network of international merchants but faces challenges in remittances and cost management. WeChat's venture into global finance is evolving, particularly in international payments. Although WeChat facilitates numerous transactions, the settlement process for overseas merchants involves additional costs. This necessity for traditional remittance services to convert foreign currencies into Chinese Yuan (CNY) using partner banks' spot exchange rates adds complexity and expenses, potentially limiting WeChat's role in international money transfers.

WhatsApp's Foray into Financial Services

Taking cues from WeChat, WhatsApp has initiated domestic money transfer services in Brazil and India. Despite initial challenges, these systems are now operational, showcasing WhatsApp's potential in the financial sector. In India and Brazil, WhatsApp utilizes the Unified Payments Interface (UPI) for effortless domestic transfers. However, its capabilities in international transfers remain absent, with significant development still required to tackle the complexities of cross-border payments.

Using Domestic Experience for International Expansion

Both WeChat and WhatsApp have established expertise in domestic money transfers, potentially paving the way for international expansion. However, this transition involves navigating additional complexities, including compliance with international financial regulations, managing foreign exchange risks, and establishing global financial partnerships.

Potential Impact and Future Prospects

These platforms hold a vast untapped market potential, given their enormous user bases. Their successful integration of international money transfer capabilities could revolutionize the remittance landscape, making transfers more accessible and affordable. However, this journey is not solely about technological innovation but also about understanding and adapting to global financial systems and consumer behavior. The path to disruption is complex, and these platforms must navigate it with technological savvy, strategic partnerships, and deep regulatory understanding.

Challenges and Strategic Partnerships

Success in this domain hinges on several factors, including impeccable execution and user trust, navigating the intricate international financial regulations, managing fluctuating exchange rates, understanding diverse market needs, and expanding customer service globally. Strategic partnerships, particularly with established financial institutions, could be instrumental in overcoming these challenges. These collaborations can offer insights and solutions for regulatory and logistical hurdles, paving the way for successful international expansion.

The Verdict

The entry of platforms like WeChat and WhatsApp into the international money transfer market would be a significant development. They promise to further reduce costs and increase accessibility in global remittances. However, their success hinges on more than just their extensive user bases. It involves a careful navigation of regulatory, technological, and market challenges. The future of international money transfers could be shaped by these platforms, but it will require strategic decisions, partnerships, and a focus on user trust and service quality. The full extent of their impact and the transformations they might bring to the global remittance landscape remains to be seen.